About SIH

SIH Divisions and Entities

SIH Healthcare is divided into several areas for their business. The ones that will be primarily focused on are Southern Illinois Hospital Services, Southern Illinois Medical Services, NFP, Southern Illinois Healthcare Enterprises, Inc., and SIH Foundation, NFP.

Southern Illinois Healthcare owns and operates three hospitals in the Southern Illinois area: Memorial Hospital of Carbondale, Herrin Hospital, and St. Joseph Memorial Hospital of Murphysboro. In addition, it controls an entity named Quality Health Partners, LLC that provides administrative services to SIH Healthcare. SIH Healthcare also owns, controls, and operates twenty five other health care facilities that are not licensed, registered or similarly recognized as a hospital facility, as listed in their 2017 IRS 990 tax forms.

Southern Illinois Healthcare and its Tax Exempt Affiliates

- Southern Illinois Hospital Services,

(commonly referred to as “SIHS”) - Southern Illinois Medical Services NFP,

(commonly referred to as “SIMS”) - Southern Illinois Healthcare Enterprises, Inc.,

(commonly referred to as “SIHE”) - SIH Foundation NFP,

(commonly referred to as “SIH Foundation”)

Future references to these and all nonprofits 503(C)(3) tax exempt corporations in this website will be collectively as “Affiliates”.

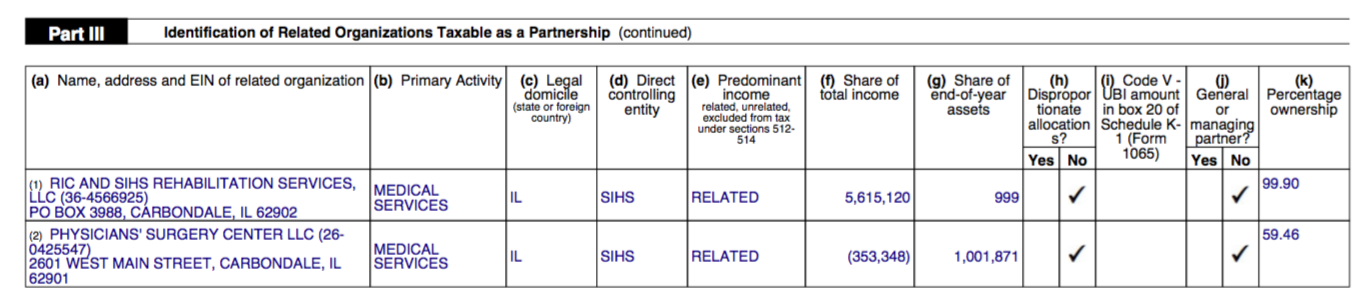

SIH Healthcare is also a partner in SIHS Rehabilitation Services, LLC (99.9% ownership), Physicians Surgery Center, LLC (59.46% ownership), and Southern Illinois Orthopedic center (34% ownership).

Note: SIH Healthcare and its Affiliates tax year is from to March 31 of each year. For example the 2017 SIH Healthcare year is from April 1, 2017 to March 31, 2018.

On the 2017 Form 990

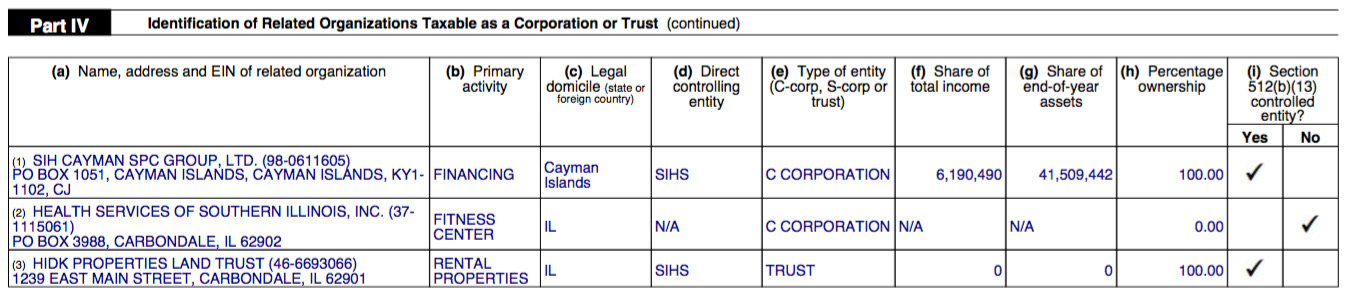

In addition, SIH Healthcare is related to three organizations taxable as an organization or trust, including SIH Cayman SPC Group Ltd, located in the Cayman Islands.

SIH Healthcare indicates that it owns 100% of a Cayman Islands entity named SIH Cayman SPC Group LTD that had income of $6,190,490 and assets held in the Cayman Islands entity of $41,509,422 during the 2017 tax year.

Governance and Membership

SIH Healthcare and each of its Affiliates are governed by and managed by a board of directors who are elected by the members of SIH Healthcare and each of its Affiliates. The members of SIH Healthcare are its members of the board of directors at the time of each and each of the Affiliate’s sole member is SIH Healthcare.

Many of the board members of SIH Healthcare and the Affiliates overlap. Here is a list of SIHS and Affiliates Board of Directors, Trustees, Senior Management, Officers, and Directors.

SIHS

Rex Budde – President

Marlene Simpson – Secretary

Terrence Glennon – Chair

Mike Hudson – Vice Chair

Steve Sabens – Trustee

Eugene Basanta – Trustee

Kathleen Fralish – Trustee

Harold Bardo – Trustee

George O’Neil – Trustee

Morton Levine – Trustee

Debra McMorrow – Trustee

Bob Mees – Trustee

Parviz Sanjabi – Trustee

SIMS

Rex Budde – President

Mike Kaser – Sr VP/CFO

Steve Sabens – Secretary

Eugene Basanta – Trustee

Kathleen Fralish – Trustee

Harold Bardo – Trustee

George O’Neil – Trustee

Morton Levine – Trustee

Brad Cole – Trustee

SIHE

Rex Budde – President

Terrence Glennon – Chair

Mike Hudson – Vice Chair

Marlene Simpson – Secretary

Steve Sabens – Trustee

Eugene Basanta – Trustee

Kathleen Fralish – Trustee

Harold Bardo – Trustee

George O’Neill – Trustee

Morton Levine – Trustee

Debra McMorrow – Trustee

Bob Mees – Trustee

Parviz Sanjabi – Trustee

SIHF

Rex Budde – President

John Annable – Secretary

Jeff Speith – Chair

Mike Monchino – Vice Chair

Marsha Ryan – Trustee

Terrence Glennon – Trustee

John Brewster – Trustee

Phil Gilbert – Trustee

Sam Goldman – Trustee

Tim Hirsch – Trustee

George Sheffer – Trustee

Diane Hood – Trustee

Mary Moreland – Trustee

Financial Structure

SIH Healthcare is a nonprofit corporation designated by the IRS as a tax exempt organization under Section 501(C)(3) of the IRS Code. It files an annual tax return utilizing IRS Form 990 on a yearly basis.

Since it is a tax exempt nonprofit corporation, it is required by the IRS to provide a copy of the Form 990 to the public. In addition, each of SIH Healthcare’s tax exempt nonprofit Affiliates is required to yearly file a Form 990 and make copies available to the public.

SIH Healthcare’s three tax exempt Affiliates are (1) Southern Illinois Healthcare Enterprise, Inc., commonly referred to as “SIHE”, (2) Southern Illinois Medical Services NFP, commonly referred to as “SIMS”, and (3) SIH Foundation NFP, commonly referred to as “SIH Foundation”. Future references to these and all nonprofits 503(C)(3) tax exempt corporations in this website will be collectively as “Affiliates”.